National News

Vehicle Owners without Third-Party insurance risk 12 months’ imprisonment

Vehicle owners in the country who fail to obtain motor vehicle insurance, commonly known as third-party insurance, now face a jail term of up to 12 months, a fine of N250,000, or both, under the new Insurance Reform Act.

Operators of commercial vehicles are now legally required to insure their passengers against death and bodily injury, with compensation of up to N2 million in cases of death or permanent disability resulting from an accident.

These provisions are contained in the new Insurance Reform Act, which was recently passed into law by the House of Representatives on Wednesday, 12th March 2025, following its earlier passage in December by the Senate.

A finalised copy of the bill will now be sent to the president for assent.

Sponsored by the Deputy Senate President, Senator Barau Jibrin, the bill provides for the recapitalisation of insurance companies in the country while imposing stricter penalties on defaulters.

The law recognises two classes of insurance in the country: life and non-life insurance. It also increases the minimum capital requirement across various insurance categories.

Once signed into law, the bill will repeal the Insurance Act 2004, the Marine Insurance Act 2004, the Motor Vehicle (Third-Party Insurance) Act 2004, the National Insurance Corporation of Nigeria Act 2004, and the Nigeria Reinsurance Corporation Act 2004.

The bill, which was passed by the Senate on 17th December 2024, aims to regulate the insurance industry while protecting the interests of policyholders, prospective policyholders, and other stakeholders. It also seeks to foster the development of a viable, competitive, and innovative insurance industry.

Additionally, the law will regulate insurance business operations in Nigeria, requiring insurance operators, directors, and management personnel to meet specific suitability requirements.

The proposed law stipulates that anyone intending to operate an insurance business in Nigeria must meet the minimum capital base requirement specified for their segment of the insurance industry.

For those involved in non-life insurance business, the law sets the capital requirement at N15 billion or a risk-based capital amount determined by the commission. For life insurance, the minimum capital base is N10 billion or a risk-based capital amount determined by the commission, while reinsurance businesses must have a capital base of N35 billion.

Furthermore, in determining the risk-based capital requirement, the commission shall consider factors such as capital for insurance risk, market risk, capital risk, and operational risk. It will also apply capital charges on assets and liabilities as deemed necessary from time to time.

Capital charges are defined as the proportion of capital required to account for potential deterioration in the economic value of an asset and the uncertainty in estimating liability due to adverse events.

According to the bill, operating an unlicensed insurance business in the country will attract a fine of N25 million or a two-year imprisonment for an individual. For a company, the penalty is N50 million or two years’ imprisonment, or both.

The bill also empowers the National Insurance Commission to revoke the licence of any insurance company that fails to conduct business in line with sound insurance practices, does not meet the capital or solvency requirements prescribed by the commission, or ceases to operate for at least one year in Nigeria.

Other conditions for licence revocation include failing to settle a judgement debt from a court of competent jurisdiction in Nigeria within 90 days, engaging in other business activities detrimental to its insurance operations, refusing to submit to an examination of its financial records, failing to comply with reporting requirements, and inadequate reinsurance arrangements.

Under the new law, no insurance company may open or close a branch or representative office within or outside Nigeria without prior approval from the commission. Insurers intending to close any of their branches or subsidiaries must provide written notice to the commission at least six months before the intended closure date.

The law also states that anyone intending to commence an insurance business in Nigeria must deposit 50 percent of the minimum capital requirement with the Central Bank of Nigeria. Failure to do so constitutes grounds for licence revocation.

Upon registration as an insurer, 80 percent of the statutory deposit shall be refunded with interest within 60 days, while existing companies must deposit an amount equivalent to 10 percent of the minimum capital stipulated in Section 15 with the Central Bank of Nigeria.

The commission is authorised to approve the investment of statutory deposits in treasury bills or other government-backed securities. Any withdrawal from the statutory deposit must be replenished within 30 days, failing which the insurer may face suspension.

Additionally, the law states that no insurer may appoint or change its principal officers without prior written approval from the National Insurance Commission. Insurers must notify the commission of any changes due to the death, dismissal, redundancy, or resignation of a principal officer.

Clause 35 of the bill stipulates that an insurer may not declare or pay dividends on its shares until all preliminary expenses, organisational expenses, commissions, broking fees, incurred losses, and other capitalised expenses not represented by tangible assets have been fully written off.

Furthermore, the bill states that, notwithstanding any other law, amounts payable as retirement life annuities, including interest, dividends, and profits, shall not be subject to tax or levies in any form.

The bill imposes a fine of N500,000 or a six-month imprisonment for anyone acting as an insurance agent without a licence. Companies and individuals acting as insurance brokers without proper registration will face fines of N10 million and N5 million, respectively.

Moreover, the bill stipulates that no person may construct or commission the construction of a building exceeding one floor without obtaining liability insurance against construction risks. This covers negligence by the owner, employees, agents, consultants, or public authorities, which may result in bodily injury or loss of life to workers or the public.

The law also mandates insurance coverage for public buildings, government assets, employees, petroleum and gas stations, products in transit, imported goods and merchandise, and professional indemnity for healthcare providers, among others.

Additionally, it requires that every fare-paying passenger in a commercial vehicle be insured against death or bodily harm. Compensation of up to N2 million, or a higher amount as specified by the commission, will be provided in cases of death or permanent disability.

Clause 99 of the bill establishes a Road Accident Victims Compensation Fund, into which 0.5 percent of underwriting profit on motor insurance business will be deposited. A committee will oversee the management of the fund.

The law also creates the Insurance Policy Protection Fund, requiring every insurer and reinsurer to contribute 0.25 percent of their gross premium income. Additionally, 0.25 percent of the balance in the Security and Insurance Development Fund as of 31st December of the preceding year will be allocated to this fund, ensuring financial security within the insurance sector.

-

News10 hours ago

News10 hours agoOpposition Reps raise alarm over alleged non-implementation of 2025 budget

-

Business10 hours ago

Business10 hours agoCurrency outside Banks rises 10.2% as money supply expands

-

World News10 hours ago

World News10 hours agoNigeria’s exports to Africa hits N4.82trn

-

News6 hours ago

News6 hours agoBREAKING: Soludo orders closure of Onitsha Main Market over sit-at-home defiance

-

National News10 hours ago

National News10 hours agoClean Energy key to survival, healthy living — Remi Tinubu

-

News2 hours ago

News2 hours agoAlleged Coup Plot: Military to arraign 16 Officers after investigation

-

News2 hours ago

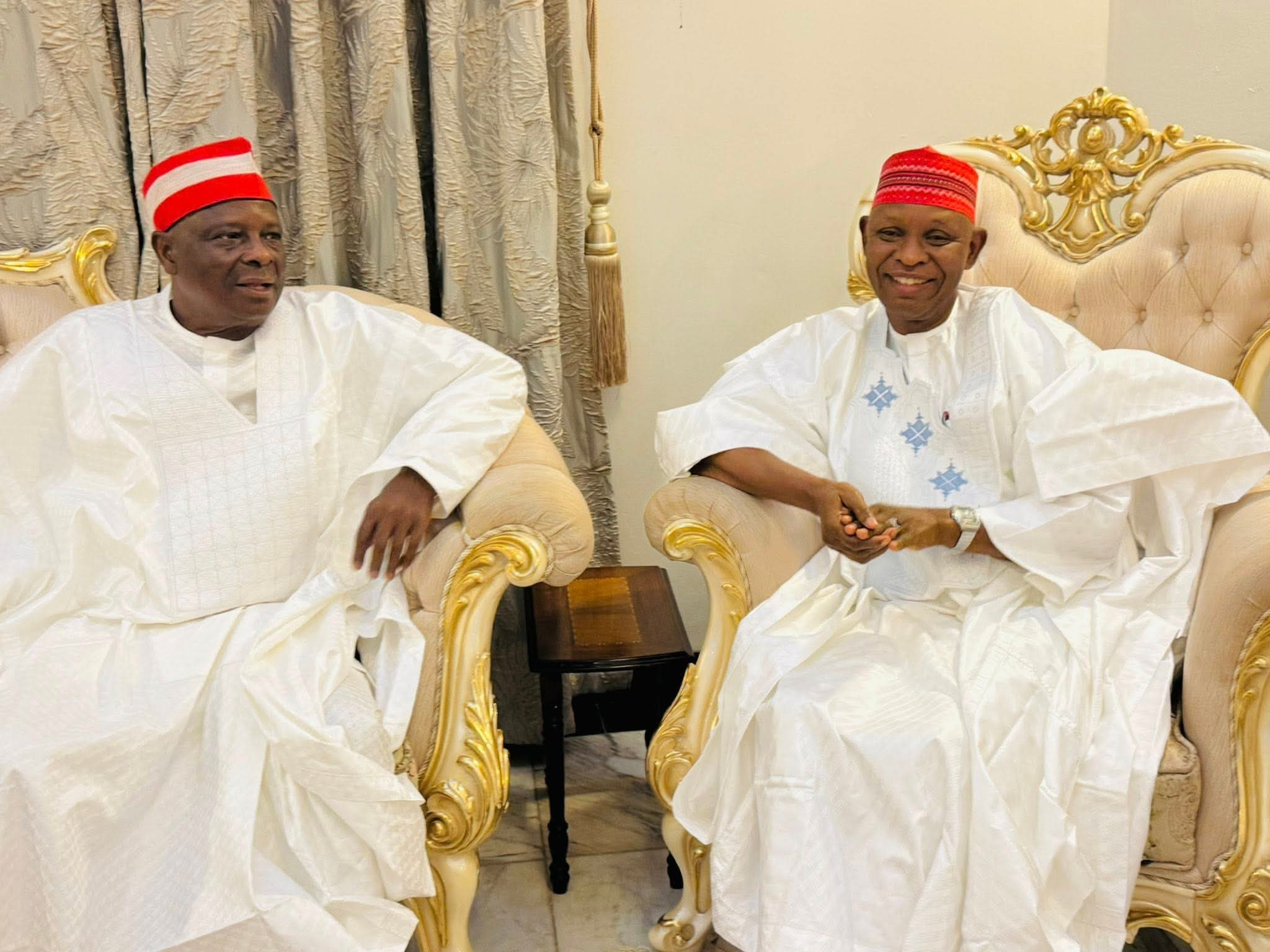

News2 hours ago21 Kano Lawmakers dump NNPP, follow Gov Yusuf to APC

-

Metro10 hours ago

Metro10 hours agoPolice Inspector killed as officers rescue kidnap victim in Oyo