National News

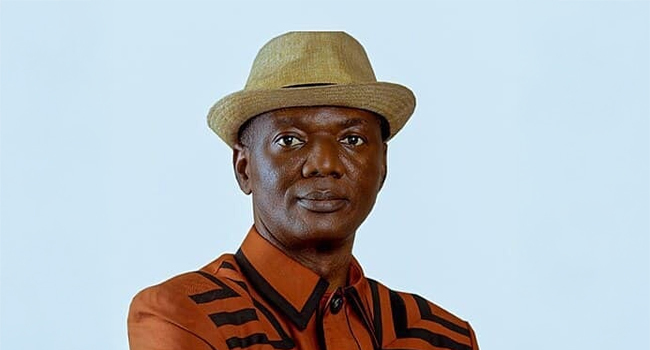

Why we must reform our Tax laws – Rep. Faleke

The Chairman of the House Committee on Finance, Rep. James Abiodun Faleke, has emphasised the need for Nigeria to overhaul its tax system to align with modern realities and enhance global competitiveness.

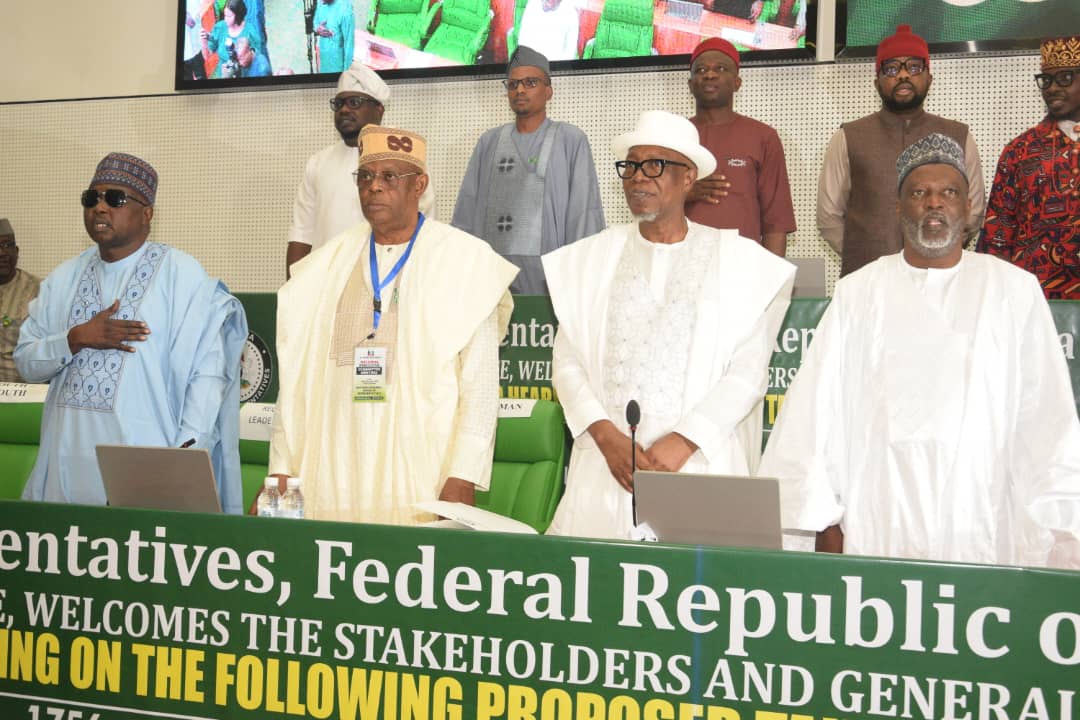

Faleke made this statement at the commencement of a three-day public hearing on four tax reform bills sent to the National Assembly by President Bola Ahmed Tinubu for consideration and passage.

The bills have generated some controversy, prompting the House to conduct extensive consultations with constituents and stakeholders in the tax sector.

Faleke, who represents the Ikeja Federal Constituency of Lagos State under the platform of the All Progressives Congress (APC), described the public hearing as a crucial step in the collective effort to modernise, harmonise, and strengthen the nation’s tax system for the benefit of all Nigerians.

“For many decades, our tax laws have remained largely unchanged. While these laws served their purpose when they were enacted, the economic and business landscape has evolved significantly over time. Some provisions in our existing tax laws are now outdated and no longer in tune with current economic realities,” Faleke stated.

He explained that the bills seek to repeal several outdated tax laws, including:

Companies Income Tax Act (CITA) – 1979

Value Added Tax Act (VAT) – 1993

Personal Income Tax Act (PITA) – 1993

Income Tax (Authorised Communications) Act – 1966

Capital Gains Tax Act – 1967

Stamp Duties Act – 1979

Casino Act – 1965

Deep Offshore and Inland Basin Act – 1999

Industrial Development (Income Tax Relief) Act – 1971

Petroleum Profit Tax Act – 1959

Venture Capital (Incentives) Act – 1993

Faleke stressed that while these laws are outdated, many have been amended several times over the years. Since 2019, successive Finance Acts have introduced “quick-fix” amendments to some of these archaic provisions. However, these amendments have been piecemeal and have not comprehensively addressed the broader issues within Nigeria’s tax system.

“Recognising the urgency of a more holistic reform, the President inaugurated the Fiscal Policy and Tax Reform Committee with a clear mandate to overhaul and simplify the tax system,” he noted.

“This committee worked assiduously to produce these tax reform bills, which collectively aim to create a tax structure that is fair, efficient, and effective in revenue collection. These bills are designed to ensure proper tax administration while making compliance easier for taxpayers.”

Low Tax-to-GDP Ratio and the Need for Reform

According to Faleke, despite being Africa’s largest economy, Nigeria’s tax-to-GDP ratio remains one of the lowest on the continent.

“In 2023, data from the International Monetary Fund (IMF) showed that Nigeria’s tax-to-GDP ratio was approximately 9.4%, compared to South Africa at 21.6%, Kenya at 14.1%, and Senegal at 19.1%,” he said.

“In the same year, total tax revenue collected by the federal, state, and local governments stood at ₦26.03 trillion. According to the Joint Tax Board (JTB), only about 35 million Nigerians pay tax, while only 9% of registered companies in Nigeria are captured in the tax net.

“This imbalance is unsustainable if we are to adequately fund critical infrastructure required to build the Nigerian economy to a desirable level. Experts estimate that Nigeria needs $3 trillion (₦1.8 quadrillion) over the next 30 years—equivalent to $100 billion annually—to bridge its infrastructure deficit. However, our internally generated revenue (IGR) falls significantly short of this amount, forcing the government to rely heavily on borrowing to bridge the funding gap.”

Faleke emphasised the urgency of implementing tax reforms that would simplify and enhance revenue collection, reduce reliance on borrowing, and drive sustainable economic development.

*A Transformative Step for Nigeria’s Tax System*

“These four bills represent a transformative step for Nigeria’s tax system. By streamlining tax laws, improving administration, and enhancing revenue collection, they will set the nation on a path of sustainable economic growth while ensuring that taxpayers contribute their fair share,” he added.

“Since the Tax Reform Bills were transmitted to the National Assembly, they have generated significant interest from Nigerians, as expected for any reform dealing with taxation. However, after careful study, the majority of Nigerians have come to terms with the contents of the bills.

“Extensive stakeholder engagements have been conducted to address concerns raised by various interest groups. Now, having passed the second reading, the bills are at a crucial stage where they are open for public scrutiny and input.

“This public hearing provides an opportunity for all concerned stakeholders to deliberate and propose necessary amendments to ensure the reforms achieve their intended objectives.

“The tax laws we seek to reform will affect all Nigerians—both individuals and businesses operating within our economy. It is, therefore, imperative that we gather input from a broad range of stakeholders to ensure that these laws serve the best interests of the people.

“We expect contributions from all invited stakeholders, including industry players, tax professionals, accountants, lawyers, the organised private sector, and economic experts, to provide constructive feedback on how these bills can be improved to better achieve their objectives.

“This hearing is not just a legislative formality—it is an opportunity for us to collectively shape Nigeria’s tax system for the future. We must ensure that our tax laws are practical, fair, and capable of driving economic growth while maintaining equity and fairness for taxpayers.

“The tax reform bills provide us with a once-in-a-lifetime opportunity to create a modern, efficient, and effective tax system for Nigeria. We must seize this moment to make the process as robust, inclusive, and credible as possible.”

-

Metro2 days ago

Metro2 days agoOyo Pastor’s daughter regains freedom after abduction

-

Metro2 days ago

Metro2 days agoEFCC set to arraign ex‑Anambra governor Ngige in court — aide confirms

-

News21 hours ago

News21 hours agoDangote slashes PMS price to N699, private depots follow with fresh reductions

-

News2 days ago

News2 days agoINEC warns poor voter register quality could undermine electoral credibility

-

Metro2 days ago

Metro2 days agoKwara lawmakers seek urgent action to stop use of fireworks

-

Metro2 days ago

Metro2 days agoKaduna communities get boost as Sen. Katung Sunday delivers aid to IDPs, rural Hospitals

-

Security2 days ago

Security2 days agoOndo Government reaffirms support for State Police as solution to rising insecurity

-

News2 days ago

News2 days agoNMDPRA cautions Nigerians as festive season nears, assures steady fuel supply