National News

Insurance companies implement measures against terrorism, money laundering

The Insurance Reforms Bill, recently passed into law by the House of Representatives, mandates all insurance companies in the country to comply with the Know Your Customer (KYC) initiative as part of efforts to combat terrorism and money laundering.

Originally passed by the Senate on 18 December 2024, the bill, sponsored by Deputy Senate President Senator Barau Jibrin, was approved by the House on Wednesday.

Clause 202 of the bill establishes provisions for Anti-Money Laundering (AML), Countering the Financing of Terrorism (CFT), and preventing the proliferation of weapons of mass destruction. It mandates that all insurance institutions must adopt policies to:

(a) Comply with KYC, AML, CFT, and Counter-Proliferation Financing (CPF) obligations under existing laws, regulations, and directives. (b) Implement internal controls to prevent any transaction linked to the proliferation of weapons of mass destruction.

Subsection 2 stipulates that the Commission shall develop regulations, guidelines, and policies in alignment with international best practices to combat money laundering and terrorism financing. Additionally, the Commission will collaborate with relevant international bodies to share data and intelligence in the fight against financial crimes.

The law grants the National Insurance Commission authority to impose administrative sanctions on non-compliant insurance companies.

Mandatory Life Assurance for Employees

The bill makes it compulsory for all employers in the country to obtain life assurance policies for their employees. It states:

- Employers must maintain a Group Life Assurance policy covering at least three times the employee’s annual total emolument.

- Premium payments must be made before coverage begins.

- In the event of an employee’s death, the underwriter must pay the named beneficiary per Section 67 of the bill.

- If an employer fails to provide coverage, they will be liable to pay three times the employee’s total compensation.

- If an employee is missing for over a year and a board of inquiry confirms a presumption of death, benefits must be paid under Section 68(2).

- Non-compliant insurers face a penalty of at least ₦10 million or as determined by the Commission.

Professional Indemnity Insurance for Healthcare Providers

Clause 80 of the bill requires all healthcare providers to maintain professional indemnity insurance from a registered insurer and display the insurance certificate at their premises. Failure to comply attracts fines as determined by the Commission in consultation with the National Health Insurance Authority.

The law also protects policyholders’ funds, stating that in cases of liquidation or business cessation, assets held by insurers cannot be seized, used for debt settlements, or claimed by creditors.

Simplified Motor Insurance Claims Process

A significant reform under the bill is the removal of mandatory police reports for certain motor insurance claims. If there is sufficient proof of loss or damage, claimants are not required to provide a police report unless the accident involves death or serious bodily injury.

For claims arising from motor accidents:

- If only one person is involved, a statement of facts from the insured and an eyewitness (if available) suffices.

- If multiple parties are involved, individual statements must align in material facts.

- However, police reports remain mandatory in cases of car theft.

The bill is now awaiting presidential assent to become law.

-

News12 hours ago

News12 hours agoOpposition Reps raise alarm over alleged non-implementation of 2025 budget

-

News9 hours ago

News9 hours agoBREAKING: Soludo orders closure of Onitsha Main Market over sit-at-home defiance

-

News4 hours ago

News4 hours agoAlleged Coup Plot: Military to arraign 16 Officers after investigation

-

News4 hours ago

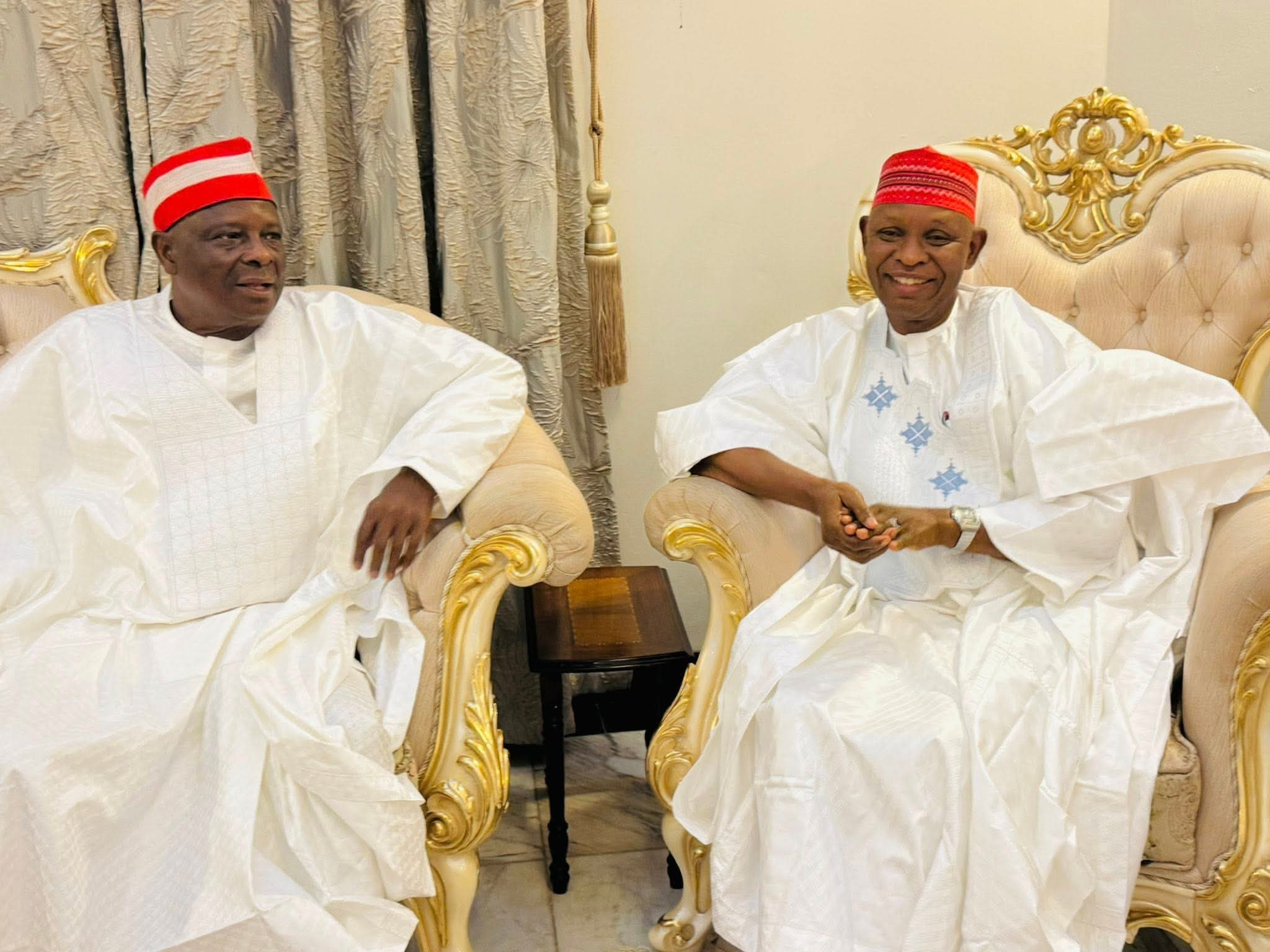

News4 hours ago21 Kano Lawmakers dump NNPP, follow Gov Yusuf to APC

-

Business12 hours ago

Business12 hours agoCurrency outside Banks rises 10.2% as money supply expands

-

World News12 hours ago

World News12 hours agoNigeria’s exports to Africa hits N4.82trn

-

National News12 hours ago

National News12 hours agoClean Energy key to survival, healthy living — Remi Tinubu

-

News4 hours ago

News4 hours agoC&S Church says 151 members still in captivity, urges FG to act