Business

CBN confirms readiness of Nigerian Banks for recapitalisation drive

The Central Bank of Nigeria (CBN) has confirmed that Nigerian banks are adequately prepared for the ongoing recapitalisation programme aimed at strengthening the banking sector and supporting the federal government’s vision of achieving a one-trillion-dollar economy.

Speaking in Abuja during the 36th edition of the Finance Correspondents and Business Editors Association of Nigeria (FICAN) seminar, the Director of Banking Supervision at CBN, Dr. Olubukola Akinwumi, assured stakeholders that the local banks are making significant progress toward meeting the recapitalisation deadline.

The seminar, which was themed “Playing the Global Game: Banking Recapitalisation Towards a One-Trillion Dollar Economy,” served as a platform to assess the banks’ capacity to meet the new capital requirements set by the apex bank.

According to Dr. Akinwumi, Nigerian banks have shown increasing credibility and resilience, particularly in navigating challenges such as exchange rate volatility. He emphasised that this credibility has enhanced investor confidence and made the sector more attractive for investment.

While refraining from disclosing how much individual banks have raised so far, Akinwumi noted that the CBN has introduced several flexible channels through which banks can meet the capital requirements. These include initial public offerings (IPOs), rights issues, private placements, as well as mergers and acquisitions.

He further disclosed that the Federal Government is driving policies that focus on critical sectors such as agriculture, infrastructure, education, and healthcare, with banks expected to play a central role in supporting these priorities.

Addressing concerns about illicit financial flows, Akinwumi maintained that the CBN will not tolerate the inflow of unverified funds into the financial system. He assured that all incoming funds will undergo rigorous verification processes to ensure transparency and security.

Also speaking at the event, Mr. Oliver Alawuba, the Group Managing Director of United Bank for Africa (UBA), emphasised the need for national collaboration to achieve the recapitalisation goals. He called for a value shift towards consuming and promoting Nigerian-made goods and services, noting that this would help boost the economy and banking sector.

Alawuba also highlighted the growing partnerships between Nigerian banks and international financial institutions, asserting that Nigerian and other African banks are increasingly dominating the continent’s financial landscape.

While expressing optimism that most banks will meet the recapitalisation deadline, he urged the CBN to show some flexibility for institutions that may require slight extensions to fully comply with the recapitalisation requirements.

-

News2 days ago

News2 days agoControversy trails Nigeria’s delegation to UN Women’s conference

-

Sports1 day ago

Sports1 day agoKano Governor sacks Head of Service Abdullahi Musa

-

News2 days ago

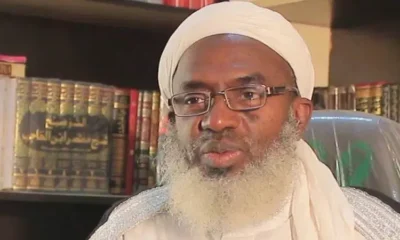

News2 days agoSheikh Gumi claims government knows identities, locations of terrorists

-

News1 day ago

News1 day agoIran warns protesters supporting foreign enemies will be treated as ‘enemies’

-

Uncategorized5 hours ago

Uncategorized5 hours agoEmpowering Women: Economic, social necessity –Faleye

-

News5 hours ago

News5 hours agoCelebrating Funke Ishola: A Trailblazer and pillar of empowerment

-

News1 day ago

News1 day agoTraders shut down Lagos International Trade Fair Complex over takeover concerns

-

News2 days ago

News2 days agoTroops repel Boko Haram attack on military base in Borno