National News

FCCPC introduces strict regulations to tackle harassment, privacy breaches by digital lenders

The Federal Competition and Consumer Protection Commission (FCCPC) has introduced new regulations aimed at curbing harassment, privacy violations, and unethical practices by digital lenders in Nigeria.

In a statement signed by the FCCPC’s Director of Corporate Affairs, Ondaje Ijagwu, and released on Wednesday, the Commission’s Executive Vice Chairman/Chief Executive Officer, Tunji Bello, unveiled the new Digital, Electronic, Online, or Non-Traditional Consumer Lending Regulations (DEON Consumer Lending Regulation) 2025, which took effect on July 21.

“For too long, Nigerians have endured harassment, data breaches, and unethical practices by unregulated digital lenders. These regulations draw a clear line that innovation is welcome, but not at the expense of the rights and dignity of consumers or the rule of law,” Bello said. He added that the rules provide a legal framework to hold offenders accountable while promoting responsible digital finance, stressing that no consumer should face harassment or be lured into unsustainable debt.

The regulations, made under Sections 17, 18, and 163 of the FCCPC Act (2018), mandate all digital lenders to register with the FCCPC within 90 days of the regulation’s commencement. Approval will be granted only to lenders that meet transparency, data protection, and consumer safety standards.

Non-compliance attracts penalties of up to ₦100 million or 1% of a company’s turnover, and directors of offending companies could face disqualification for up to five years. The rules also ban pre-authorised lending, unethical marketing practices, and monopolistic agreements without prior approval. Lenders must provide clear loan terms, ensure joint registration of partnerships, and maintain local ownership of at least one service provider for airtime and data lending services.

The Commission urged all Mobile Money Operators (MMOs), Digital Money Lenders (DMLs), and other service partners to obtain application forms and comply with the new requirements, while encouraging consumers to report unregistered lenders, unfair interest rates, and privacy violations.

-

Uncategorized12 hours ago

Uncategorized12 hours agoEmpowering Women: Economic, social necessity –Faleye

-

News1 day ago

News1 day agoIran warns protesters supporting foreign enemies will be treated as ‘enemies’

-

Sports1 day ago

Sports1 day agoKano Governor sacks Head of Service Abdullahi Musa

-

Sports1 day ago

Sports1 day agoFlying Eagles midfielder Daniel Daga sentenced to six months in Norway

-

News12 hours ago

News12 hours agoCelebrating Funke Ishola: A Trailblazer and pillar of empowerment

-

News1 day ago

News1 day agoTraders shut down Lagos International Trade Fair Complex over takeover concerns

-

National News1 day ago

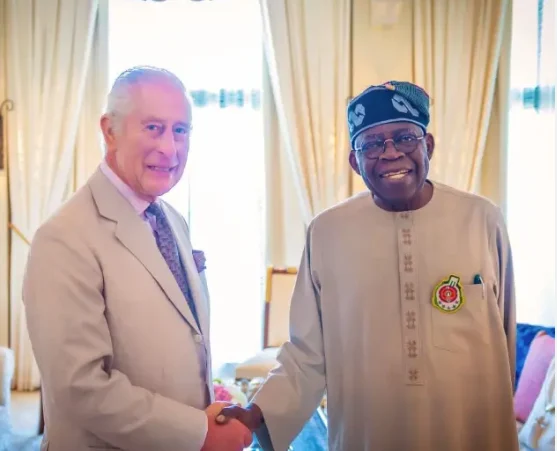

National News1 day agoTinubu nominates Lamido Yuguda as CBN Deputy Governor

-

World News1 day ago

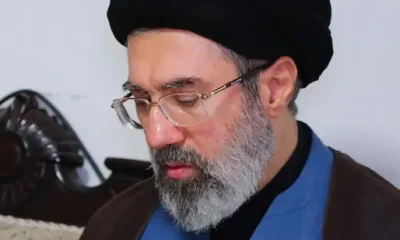

World News1 day agoIran’s new Supreme Leader Mojtaba Khamenei injured but safe, official says