Business

NNPCL’s ₦10 Trillion Remittance – A Landmark or a Lesson?

The recent announcement by the Nigerian National Petroleum Company Limited (NNPCL) of remitting an astounding ₦10 trillion to the Federation Account by September 2024 is both remarkable and thought-provoking. This figure, coupled with an additional ₦3.5 trillion in dividends and taxes for the year, paints the picture of a financially robust organisation. However, beneath these numbers lies a deeper narrative concerning governance, transparency, and the evolving role of NNPCL within Nigeria’s oil sector.

The transformation of NNPCL into a commercial entity under the Petroleum Industry Act (PIA) has significantly altered how it operates and contributes to national revenue. Instead of direct payments into the Consolidated Revenue Fund, its contributions now come in the form of dividends and taxes. This new structure aims to align NNPCL with global best practices.

Mele Kyari, the Group Chief Executive Officer, has been outspoken about the company’s transparency, emphasising the publication of its transactional accounts and its status as Nigeria’s highest taxpayer and royalty contributor. These achievements are commendable in a country where public institutions are often criticised for lacking transparency. Yet, Kyari’s remarks about delays in remitting taxes and royalties, alongside challenges with fuel price adjustments, highlight that the journey is far from smooth.

The delayed implementation of Premium Motor Spirit (PMS) price adjustments until 1 October 2024 underscores the complex interplay of politics, economics, and public sentiment. Fuel pricing in Nigeria has always been contentious, with the government walking a fine line between fiscal responsibility and public appeasement. This delay likely strained NNPCL’s cash flow and, by extension, its ability to meet remittance timelines.

Another notable point from Kyari’s address is the company’s reduced control over oil production. While this decentralisation allows for a more competitive and diversified oil sector, it also complicates efforts to coordinate and maximise production and revenue. That said, achieving over 90 per cent of its 2024 production target is a significant feat, especially given the persistent challenges in Nigeria’s oil and gas sector, including theft, sabotage, and fluctuating global oil prices.

NNPCL’s performance in 2024 further underscores its potential to drive substantial economic impact. However, the issues of delayed payments and fuel price adjustments point to the need for better planning and policy alignment.

Ultimately, the ₦10 trillion remittance is more than just a figure—it serves as a reminder of Nigeria’s immense wealth and the critical responsibility of managing it judiciously.

-

Uncategorized12 hours ago

Uncategorized12 hours agoEmpowering Women: Economic, social necessity –Faleye

-

Sports1 day ago

Sports1 day agoKano Governor sacks Head of Service Abdullahi Musa

-

News1 day ago

News1 day agoIran warns protesters supporting foreign enemies will be treated as ‘enemies’

-

Sports1 day ago

Sports1 day agoFlying Eagles midfielder Daniel Daga sentenced to six months in Norway

-

News11 hours ago

News11 hours agoCelebrating Funke Ishola: A Trailblazer and pillar of empowerment

-

News1 day ago

News1 day agoTraders shut down Lagos International Trade Fair Complex over takeover concerns

-

National News1 day ago

National News1 day agoTinubu nominates Lamido Yuguda as CBN Deputy Governor

-

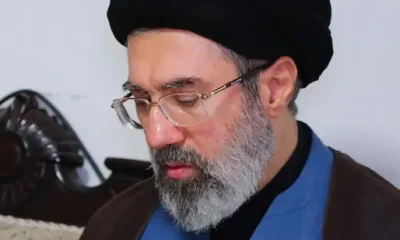

World News1 day ago

World News1 day agoIran’s new Supreme Leader Mojtaba Khamenei injured but safe, official says