World News

UK inflation drops ahead of Labour Government’s crucial budget

Britain’s annual inflation rate eased again in October, offering a small measure of relief to the Labour government just a week before it presents a new national budget.

According to figures released on Wednesday by the Office for National Statistics (ONS), the Consumer Prices Index rose by 3.6% over the last 12 months, down from 3.8% in September.

The Labour government is expected to introduce tax increases in its November 26 budget as it tries to reduce national debt and boost funding for public services. The party continues to trail badly in opinion polls and is under pressure to revive the sluggish economy.

Finance minister Rachel Reeves welcomed the drop, describing it as “good news for households and businesses,” but said more must be done to reduce living costs. She added that next week’s budget will focus on cutting NHS waiting lists, reducing debt, and easing the cost of living.

The ONS attributed the slowdown mainly to gas and electricity prices rising at a slower pace than last year, although this was partly offset by a fresh increase in food prices.

Some analysts believe the latest figures make it more likely that the Bank of England (BoE) will cut interest rates in December. However, the final decision may depend on the impact of next week’s budget.

The new data comes after Britain’s economy weakened in the third quarter, with unemployment rising. Labour, which returned to power in July 2024 after 14 years of Conservative rule, has been criticised for failing to deliver strong growth. Economists have also blamed last year’s decision by Reeves to raise a key business tax for slowing down the economy.

Analyst Isaac Stell said “all eyes now turn to the budget,” noting that tax increases are expected. He added that the BoE is prepared to offer a pre-Christmas rate cut, which could bring some relief to households and businesses struggling with high borrowing costs.

The Bank of England kept its main interest rate at 4.0% earlier this month, with governor Andrew Bailey saying the central bank needs more evidence that inflation will return to its 2% target.

A rate cut, when it happens, is usually passed on by retail banks, helping to lower mortgage and business loan costs.

AFP

-

Uncategorized2 days ago

Uncategorized2 days agoNUJ partners TETFUND on improved educational development, seek more funding for sector

-

Feature1 day ago

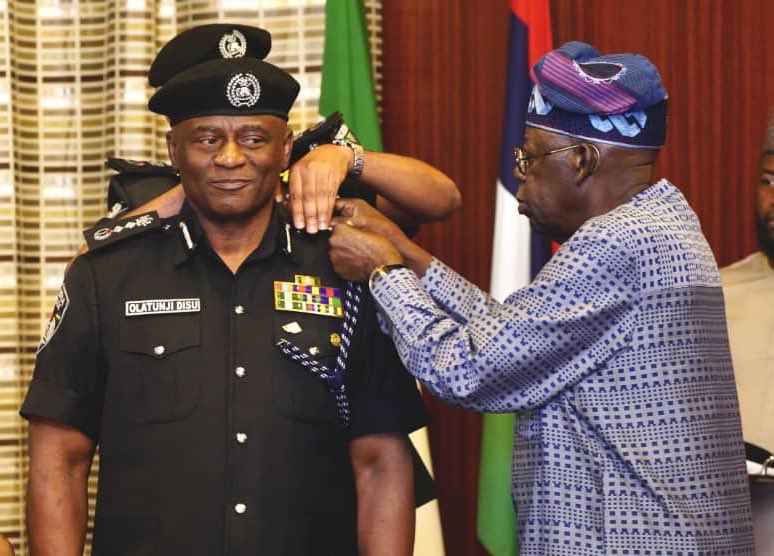

Feature1 day agoBiography of Tunji Disu, the newly appointed Inspector-General of Police

-

News2 days ago

News2 days agoICPC arraigns Ebonyi official over alleged N61m fraud

-

News2 days ago

News2 days agoCrisis rocks ADC in Edo as party leaders shut out of Odigie-Oyegun’s meeting

-

News2 days ago

News2 days agoECOWAS Parliament Urges stronger democracy, faster AfCFTA implementation

-

Uncategorized2 days ago

Uncategorized2 days agoBREAKING :Nass shifts plenary Resumption to March 5

-

News2 days ago

News2 days agoOkpebholo has laid foundation for Tinubu’s re-election – Wike

-

National News1 day ago

National News1 day agoBREAKING: Tinubu removes IGP Egbetokun, names successor