National News

FIRS orders 10% withholding Tax on Interest from short-term securities

The Federal Inland Revenue Service (FIRS) has directed banks, stockbrokers, and other financial institutions to begin deducting a 10 per cent withholding tax on interest earned from short-term investments.

Previously, earnings from such instruments were tax-exempt to encourage investor participation and improve returns. However, according to a Reuters report, the new policy mandates that the tax be deducted at the point of payment for instruments such as treasury bills, corporate bonds, promissory notes, and bills of exchange.

While the federal government has not disclosed the projected revenue from this directive, the move is expected to widen Nigeria’s tax net and boost non-oil income.

FIRS stated that investors would receive tax credits for amounts withheld unless the deductions are deemed final. The agency clarified that interest earned from federal government bonds will remain exempt from the levy.

“All relevant interest-payers are required to comply with this circular to avoid penalties and interest as stipulated in the tax law,” FIRS Executive Chairman, Zacch Adedeji, said in the notice.

Short-term securities, particularly treasury bills, are popular among investors due to their attractive yields and quick maturity periods.

-

News2 days ago

News2 days agoObi camp dismisses arrest speculation ahead of 2027

-

News2 days ago

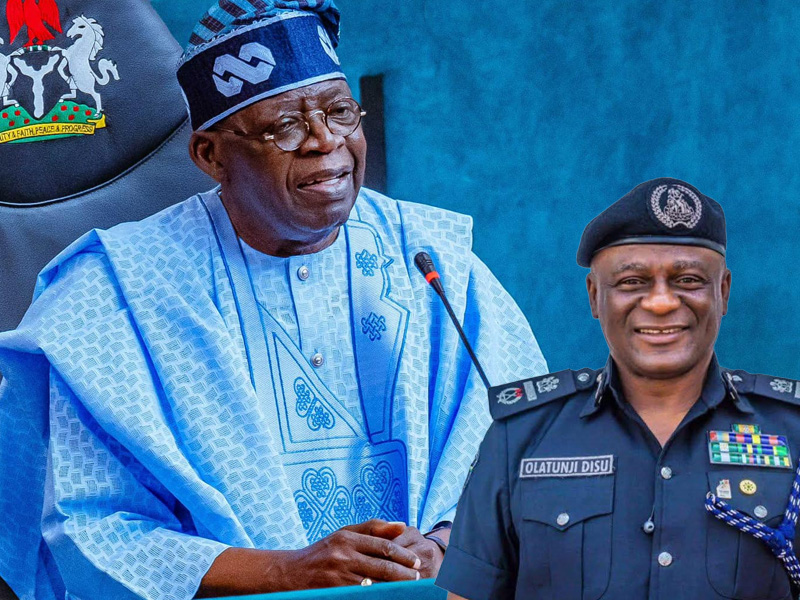

News2 days agoFCT polls expose ‘corn and groundnut’ campaign style – Wike

-

News2 days ago

News2 days ago12 Killed in separate attacks in Plateau communities

-

News2 days ago

News2 days agoEFCC arrests 20 over vote buying, electoral offences in FCT polls

-

Metro2 days ago

Metro2 days agoOne killed as vehicle overturns near Tipper Garage in Abuja

-

World News2 days ago

World News2 days agoMexico’s most wanted, El Mencho, killed in military operation

-

Uncategorized1 day ago

Uncategorized1 day agoNUJ partners TETFUND on improved educational development, seek more funding for sector

-

National News2 days ago

National News2 days agoTransform Nigeria’s automotive policy into law, NADDC boss tells NASS