National News

VAT revenue jumps 84% to N6.7trn

Nigeria’s Value Added Tax (VAT) revenue surged by 84.6 percent year-on-year to N6.72 trillion in 2024, up from N3.64 trillion recorded in 2023, according to the National Bureau of Statistics (NBS).

A breakdown of the data from NBS shows that VAT collections rose by 9.09 percent quarter-on-quarter to N1.56 trillion in the second quarter of 2024, compared to N1.43 trillion in the first quarter. The upward trend continued in the third quarter with a 14 percent increase to N1.78 trillion, and further climbed by 9.5 percent to N1.95 trillion in the fourth quarter.

In its report for Q4 2024 released on Monday, NBS stated that domestic VAT payments amounted to N917.40 billion, non-import foreign VAT payments stood at N554.68 billion, while import VAT contributed N474.75 billion.

On a quarter-on-quarter basis, the activities of extraterritorial organizations and bodies recorded the highest growth rate at 180.05 percent, followed by agriculture, forestry and fishing at 70.83 percent, and human health and social work activities at 46.13 percent.

Conversely, VAT from households as employers, as well as undifferentiated goods and services-producing activities for own use, contracted by 28.97 percent, while information and communication activities declined by 23 percent.

-

News2 days ago

News2 days ago12 Killed in separate attacks in Plateau communities

-

News2 days ago

News2 days agoAPC receives newly elected FCT Council Chairmen after electoral sweep

-

Uncategorized1 day ago

Uncategorized1 day agoNUJ partners TETFUND on improved educational development, seek more funding for sector

-

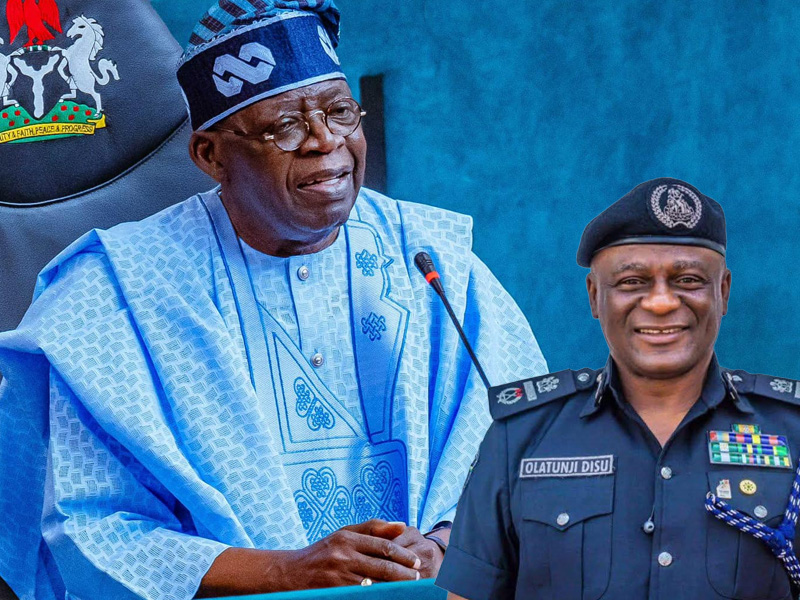

Feature18 hours ago

Feature18 hours agoBiography of Tunji Disu, the newly appointed Inspector-General of Police

-

National News2 days ago

National News2 days agoTransform Nigeria’s automotive policy into law, NADDC boss tells NASS

-

News2 days ago

News2 days agoJUST-IN: Fire breaks out at Lagos Airport Terminal

-

News2 days ago

News2 days agoBREAKING: El-Rufai sues ICPC, seeks N1bn over alleged unlawful search of Abuja home

-

News2 days ago

News2 days agoICPC arraigns Ebonyi official over alleged N61m fraud