National News

Tinubu to sign Tax Reform Bills into Law Thursday

President Bola Ahmed Tinubu is expected to officially sign into law four landmark tax reform bills on Thursday, aiming to reshape Nigeria’s fiscal environment, enhance tax administration and attract fresh investments into the country.

The four bills — the Nigeria Tax Bill, Nigeria Tax Administration Bill, Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill — recently received approval from the National Assembly after a series of stakeholder meetings and technical evaluations.

According to a statement released on Wednesday by the Special Adviser to the President on Information and Strategy, Bayo Onanuga, the signing will take place at the State House in Abuja. He described the reforms as a major milestone in the president’s economic plan, pointing out that the new laws would simplify tax processes, increase government revenue, and improve the ease of doing business in Nigeria.

“These laws will significantly transform tax administration in the country, leading to increased revenue generation, an improved business environment, and a boost in domestic and foreign investments,” the statement said.

The signing event will be attended by several government dignitaries, including the President of the Senate, Speaker of the House of Representatives, top leaders from both chambers of the National Assembly, finance ministers, and heads of relevant government agencies.

Among the reforms is the Nigeria Tax Bill (Ease of Doing Business), which aims to merge Nigeria’s fragmented tax laws into a single, unified statute, cutting down on multiple taxation and easing the burden of compliance for businesses and individuals.

The Nigeria Tax Administration Bill will set a consistent legal and operational framework for tax administration across federal, state, and local government levels, seeking to reduce conflict and duplication in tax collection.

Also slated for signing is the Nigeria Revenue Service (Establishment) Bill, which will repeal the current Federal Inland Revenue Service (FIRS) Act and set up a new autonomous Nigeria Revenue Service (NRS). This agency will be tasked not only with tax collection but also the collection of other government revenues, operating under stricter transparency and performance guidelines.

The fourth bill, the Joint Revenue Board (Establishment) Bill, will establish a formal body to ensure better coordination and cooperation among tax authorities across the country. It will also introduce accountability structures such as a Tax Appeal Tribunal and an Office of the Tax Ombudsman to handle tax-related disputes fairly.

These reforms are expected to modernise Nigeria’s tax system, improve revenue inflow, and create a more business-friendly environment.

-

Feature1 day ago

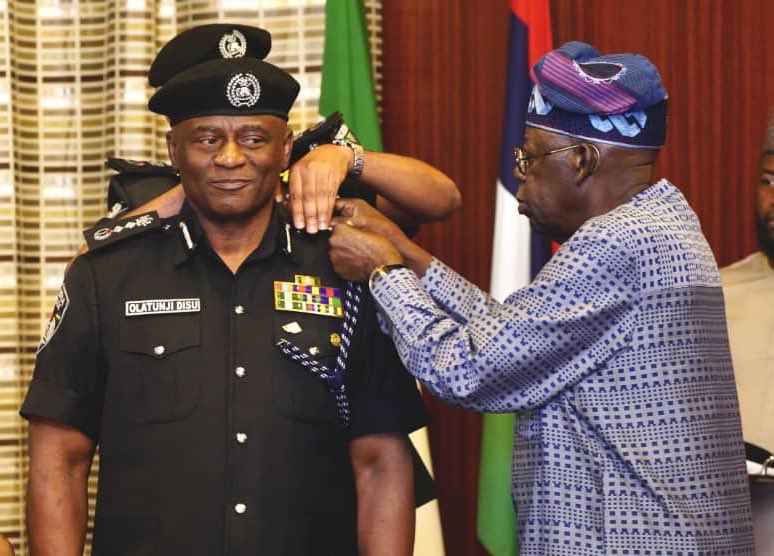

Feature1 day agoBiography of Tunji Disu, the newly appointed Inspector-General of Police

-

National News2 days ago

National News2 days agoBREAKING: Tinubu removes IGP Egbetokun, names successor

-

World News1 day ago

World News1 day agoPolice arrest two women for kissing in public in Uganda

-

NUJ FCT1 day ago

NUJ FCT1 day agoBREAKING: FCTA Health Mandate Secretary offers 150 free insurance slots to NUJ FCT members

-

News2 days ago

News2 days agoFIFA proposes one-minute rule for injured players to curb time-wasting

-

News2 days ago

News2 days agoNigeria emerging stronger, best yet to come – Tinubu

-

News2 days ago

News2 days agoNigerian Army thwarts ambush, kills five suspected Lakurawa terrorists in Kebbi

-

Business1 day ago

Business1 day agoCBN eases benchmark interest rate to 26.5%